10 Smart Money Moves Every Retiree Should Make for Financial Security

Retirement marks a significant transition in one’s life—a time to savor the fruits of your labor and enjoy newfound freedom. However, to make the most of this chapter, careful financial planning is essential. Here are 10 smart money moves tailored for retirees to ensure financial security and peace of mind:

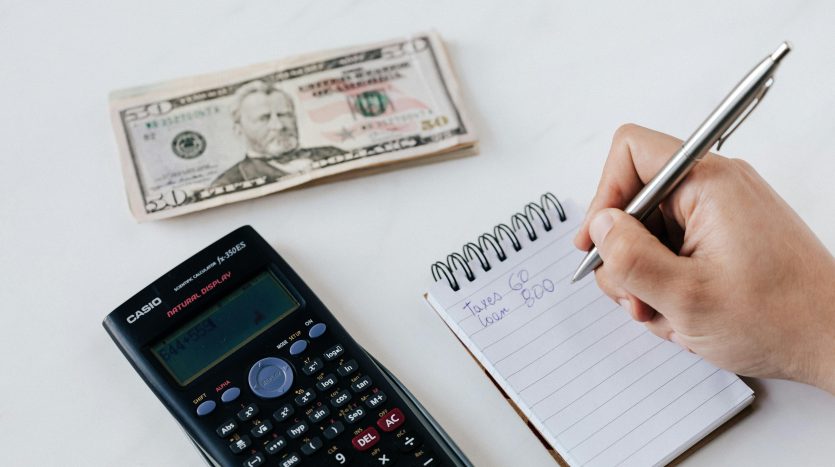

1. Create a Detailed Budget

Crafting a comprehensive budget is the cornerstone of financial stability in retirement. Start by outlining your essential expenses, such as housing, healthcare, and groceries, then allocate funds for discretionary spending and leisure activities. Regularly review and adjust your budget to align with your evolving needs and priorities.

2. Maximize Retirement Account Withdrawals

Strategically withdrawing funds from your retirement accounts can minimize taxes and prolong the longevity of your savings. Consider consulting a financial advisor to determine the optimal withdrawal strategy based on factors like age, tax bracket, and investment portfolio.

3. Diversify Your Investment Portfolio

Maintaining a diverse investment portfolio is crucial for mitigating risk and maximizing returns during retirement. Allocate your assets across various asset classes, including stocks, bonds, real estate, and memorial lot investments, to minimize exposure to market volatility and safeguard your financial future.

4. Explore Supplemental Income Opportunities

Generating additional income streams as retiree can provide a financial cushion and enhance your quality of life. Explore opportunities such as part-time work, freelancing, rental properties, or monetizing hobbies to bolster your cash flow and maintain financial independence.

5. Consider Long-Term Care Insurance

As you age, the cost of long-term care services can pose a significant financial burden. Investing in long-term care insurance can help cover expenses associated with nursing homes, assisted living facilities, or in-home care, safeguarding your assets and preserving your financial legacy.

6. Review Social Security Benefits

Maximizing your Social Security benefits requires careful planning and timing. Consider factors such as your life expectancy, marital status, and other sources of retirement income when deciding when to claim benefits. Delaying Social Security can result in higher monthly payments, providing greater financial security in the long run.

7. Manage Healthcare Costs Wisely

Healthcare expenses can escalate in retirement, impacting your financial well-being. Evaluate Medicare options, including supplemental coverage and prescription drug plans, to minimize out-of-pocket costs. Additionally, prioritize preventive care and healthy lifestyle choices to reduce medical expenses over time.

8. Protect Against Identity Theft and Fraud

Safeguarding your personal and financial information is paramount in today’s digital age. Take proactive steps to protect yourself against identity theft and financial fraud by monitoring your accounts regularly, using strong passwords, and staying vigilant against phishing scams and fraudulent schemes.

9. Plan for Estate and Legacy Planning

Estate planning ensures that your assets are distributed according to your wishes and minimizes potential conflicts among beneficiaries. Create or update essential documents such as wills, trusts, and powers of attorney to protect your estate and provide for your loved ones after you’re gone.

10. Stay Informed and Flexible

The financial landscape is constantly evolving, necessitating ongoing education and adaptability. Stay informed about economic trends, tax laws, and retirement planning strategies to make informed decisions and adjust your financial plan accordingly. Remain flexible and open to adjusting your goals and strategies as needed to navigate life’s uncertainties with confidence.

In conclusion, implementing these 10 smart money moves can empower retirees to achieve financial freedom and enjoy a fulfilling retirement journey. By prioritizing financial planning, diversification, and proactive decision-making, you can embark on this new chapter with confidence and peace of mind.