Are Memorial Lots Profitable Investments?

Recent years provided countless, prime investment opportunities to the general public. The industry introduced stocks, insurance, real estate, mutual funds, cryptocurrencies, and crowdfunding among others. Over the years, we have been advocates of real estate investments particularly memorial lot investments. But this begs the question: are memorial lots profitable investments?

Real Estate Industry For 2021

The real estate sector is the top contributor to the Philippine economy on the basis of GDP alone. Studies show that it generated a total of 126 Billion Pesos value as of the second quarter of 2021. Surprisingly enough, the real estate industry remained resilient and competitive. This is despite the ongoing difficulties imposed by the pandemic and the surge of various COVID-19 variants across the country. Meanwhile, the Sentiment Index Score achieved an all time high of 65 during Q4 of 2021. Experts attribute this to reduced uncertainty factors on the economic front. In turn, this leads to a much more stable demand on the market.

It is also worth noting the fact that the middle class population grows considerably and consistently over the years. The purchasing power of Filipino people, consequently, becomes more sustainable. As a direct result, we now enjoy a much higher investing power. The surge in excess monetary funds encouraged many people to indulge themselves on various forms of real estate investments. There are residential lots, condominium units, and memorial lot properties. Are memorial lots profitable investments? How about residential lots? Or the condos?

Economy on the Road to Recovery

While not totally unimpeded, the real estate industry saw its fair share of struggles both in delivery, sales, and operations. 2022 as a whole is viewed by many experts as pivotal towards the road to recovery. Aiding the recovery of this sector in the country will be beneficial to the economy as a whole. As a matter of fact, the real estate industry projects the fastest GDP growth rate at 7% among the ASEAN 5.

Overall, it is a point of interest to keep an eye on the recovery plans of both the government and the developers. This is particularly true if you invested heavily on the real estate industry.

Increased OFW Remittances

Bangko Sentral ng Pilipinas reported a substantial increase of 5.3% to the total remittances of OFW’s as of November 2021. This tallies total remittances to $31.5 Billion for the 3Q of 2021 compared to $29.9 Billion from 3Q 2020. United States, Singapore, and Saudi Arabi remittances contributed greatly to this accomplishments by our foreign workforce, easing the economic burden brought about by the aftermaths of the pandemic.

While most currencies experienced depreciation as expected, the constant inflow of dollars from OFWs together with the receipts from Business Process Outsourcing helped support the Peso.

“We can expect these two structural types of flows to continue to flow in 2022, helping steady the [peso] yet again,” Nicholas Mapa, ING Bank senior Philippines economist, said on an interview.

A huge number of real estate developers have seen a surge of OFW clients and investors during the past few years. Because of the increased financial capacity of OFWs and the promise of real estate investments, the value of properties offered is now on a premium.

Memorial Lot Investments

Golden Haven offers prime memorial lot properties to two major client bases: end-users and investors. Based on a consolidated report, 60% of the market purchases memorial properties for their functional usage: personal use when someone dies. After all, it is a memorial park.

The remaining 40%, however, reserved their properties purely for investment purposes. The typical memorial lot investor eyes the newer projects specifically while they are still on the pre-planning stages of development. Come the operation and launching, they will see a significant return on their investments. Listed below are the price appreciation on some of these projects. This is a testament that memorial lots are profitable investments.

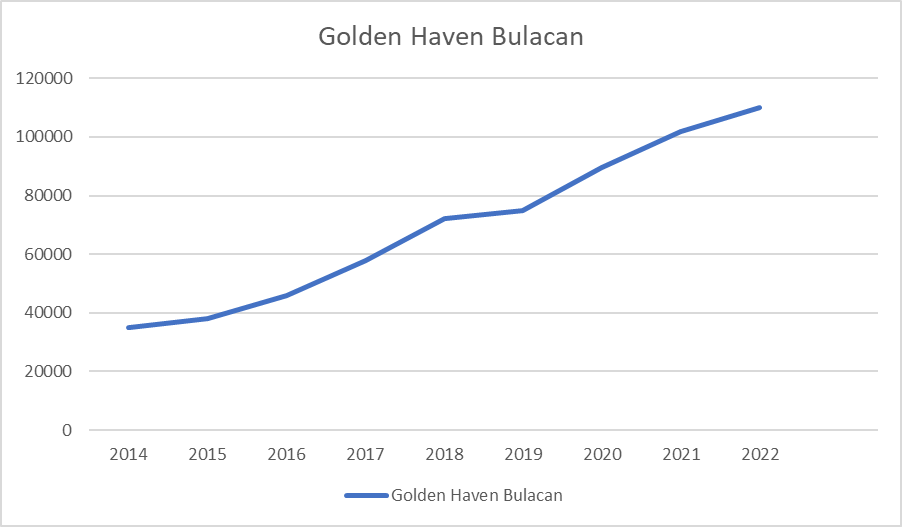

Golden Haven Bulacan

Golden Haven Bulacan started selling properties at a price of 35,000 Pesos way back in 2014. Year after year, the clients of Golden Haven Bulacan enjoyed annual appreciation on their properties’ value. Annual appreciation is at a rate of 15% while the overall appreciation from date of launch is at a whopping 214% in just a span of eight years.

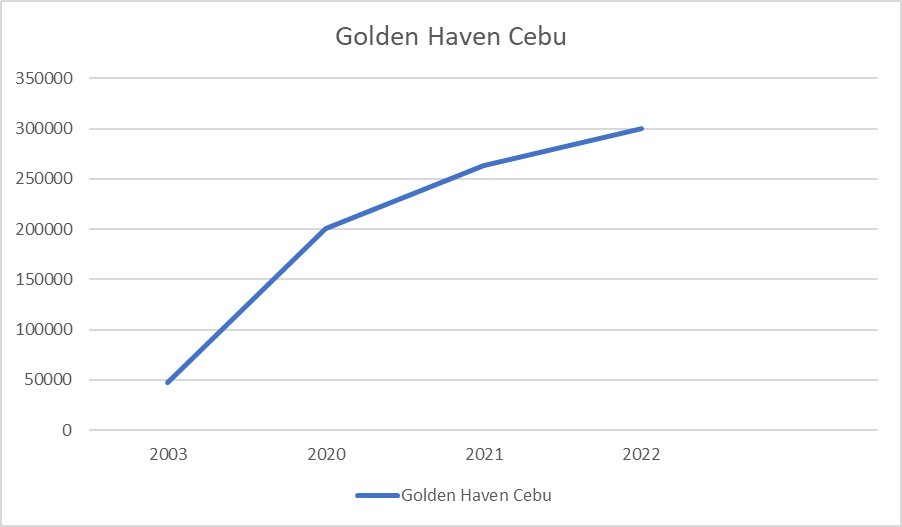

Golden Haven Cebu

Golden Haven Cebu, on the other hand, started at a price of 47,000 Pesos on 2003 and is now valued at 300,000 Pesos. That is a staggering 538% increase in value of aforementioned properties. Not only is Metro Cebu one of the up and coming business districts in the Philippines, it is also home to one of the major tourist destinations in the country, making it a much more appealing investment location.

READ MORE: Cebu Is Your Next Prime Investment Opportunity

Golden Haven Cagayan De Oro

Golden Haven Cagayan De Oro, over the course of a decade, satisfied investors with a record-breaking 282% ROI in the area. Not one of any other memorial park developer even comes close. The steep appreciation from 2016 to 2022 indicates a significant increase and aggressive growth of the brand in the Misamis Oriental region.

Conclusion

Numbers don’t lie. Memorial lots are profitable investments. If you are a vying investor, you should know the integrity of track records and their importance to making sound investment decisions. This is an opportune time to enter the real estate market. Once the recovery of the industry is achieved in the near future, you can expect the price to surge dramatically in value. Not to mention the fact that memorial lots are considered nowadays to be more of a necessity than a luxury.

READ MORE: Golden Haven Memorial Park News and Update